Credit

Video: All About Credit

Know Or You Will Owe

Credit is a contractual agreement in which a borrower receives something of value now and agrees to repay the lender at a later date. You borrow now with the promise of paying later. There are two main forms of credit:

1) Loans

There are two main types of loans: secured and unsecured. A loan is secured if there is a physical item that can be taken back if the loan is not paid. For example, a car loan is a secured loan because if loan payments are missed the car can be repossessed to gain back the value of the loan. An example of an unsecured loan are Federal Student Loans. If loan payments are not made, there's no physical item to be taken back; your education cannot be taken from you.

2) Credit Cards

Credit cards are easy to get and easy to overuse. They can come with high interest rates, costly fines and damage to your credit score. Some things to look for when applying for a credit card are: the interest rate, the annual fee, the late fee, the over-the-limit fee and the grace period. Here is additional information on what you need to know before accepting a credit card.

Credit Report

Your credit report contains information about your identity (name, address, birth date, Social Security Number), the amount of credit you currently have and how much you owe, any court judgments against you, bankruptcy, any companies who recently requested a copy of your report, etc.

Your credit report is used to determine whether you can get a credit card, loans to buy a house or car, if your landlord should rent to you or if you should be hired. It is also used to determine what kind of loan you will be offered, how much credit you are eligible for and what your interest rate will be.

Credit Reporting Companies

There are three main reputable credit bureaus that collect information on your payment history from creditors, lenders, utilities, debt collection agencies and courts. Those bureaus are Experian, TransUnion and Equifax.

All three of those bureaus report to one site where you can get your free annual credit report or you can visit each of the three bureaus individually and check your credit score multiple times per year.

Negative Credit Information

Many people have questions about how long negative information stays on their credit reports and the answer is: seven years, generally. Things like personal bankruptcy stay on your report for ten years. Lawsuits or an unpaid judgment against you will stay on your Credit Report for seven years or until the statute of limitations runs out (whichever is longer). Criminal convictions can stay on your record forever.

Security Freeze

One of the most effective ways of preventing identity theft is to put a security freeze on your credit files. This prevents those files from being shared with potential creditors and having new lines of credit opened. This means that you would not be able to open new lines of credit under your name (unless you lifted the freeze!) but it also means someone cannot falsely open a line of credit under your name, i.e. identity theft. More information about security freezes for Montanans can be found here.

"Firm Offers"

Many people receive unwanted credit card offers and insurance quotes in the mail that they usually end up just throwing away. These are called "firm offers" and you can stop or lessen the number you receive by opting out of these prescreened offers. By going to the official Consumer Credit Reporting Industry website, you can opt out of firm offers of credit or insurance for 5 year periods or opt out permanently.

Credit card and insurance companies get your information by contacting consumer reporting companies and asking for a list of people who meet some specified criteria (like a minimum credit score) and if the reporting company gives them the list then they will contact those individuals with a credit card offer or insurance quote. Opting out can stop or reduce this from happening. The Federal Trade Commission has more information on prescreened credit and insurance offers.

While these offers may not show up on your credit report, those credit card offers you get in the mail can lead to identity theft if someone gets a hold of one of your credit card offers, fills it out and starts making purchases. Stopping these firm offers can be one step towards keeping your identity secure.

Credit Score

Your credit score is your reputation as a borrower and is represented by a number usually ranging from 300 to 850. It tells others how well you handle credit: the higher the score, the more likely it is that you will pay back the money you borrow.

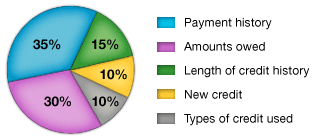

Your credit score is based off of many things but the five major categories include your payment history (whether you pay your bills on time or late), the amount of debt you have in your name (yep, your student loans count towards this category!), the age of your accounts, the new credit you are pursuing and the types of credit you use (see above image).

STEPS TO BUILDING A GOOD CREDIT SCORE:

- Pay your bills on time or build strong payment patterns

- If you have debt in collections, start making payments to get out of that situation

- If you have to have a credit card, maintain only one

- Establish a relationship with Local Lender (open a checking/savings account)

- Establish a credit history (only need 1 or 2 accounts and start small)

- Apply for a secured loan at a credit union

- Avoid charging close to your credit line limit: keep your balance low!

- Stop using credit cards and pay down debts (credit is not an extension of your income!)

- Review your credit report annually and correct any errors

- Limit inquiries on your credit report by not applying for too many new accounts at once (firm offers do not count as inquiries!)

- Be patient!

The Federal Trade Commission has more information on Credit Scores and Credit Reports.

The "Debt Snowball"

Debt can pile up very quickly and it's easy to feel overwhelmed by what you owe. In order to conquer your debt, use a process called "The Debt Snowball".

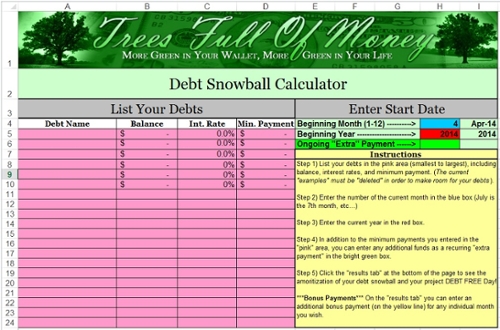

This process is a debt reduction strategy that has you pay off your smallest debt first and the monthly money used to pay that debt is then applied toward making additional payments on the next-smallest debt, and so on until all debts are repaid. You take out the smallest debt first, while still maintaining minimum payments on everything else. Keep stepping up to the next larger bill until all debt is gone!

The Debt Snowball Methodology

List your debts in order, with the smallest balance first. Do not be concerned with interest rates or terms unless two debts have similar balances, then list the higher interest rate debt first. Paying the little debts off first gives you quick feedback, and you are more likely to stay with the plan as you see these fast results.

Below is a link to an Excel version of the Debt Snowball Calculator. Use it to calculate what payments to make each month in order to become debt free!