Budgeting

Video

Spend Reasonably, Save Responsibly and Enjoy Peace of Mind About Your Finances

Step 1) Start your budget by reviewing your past spending.

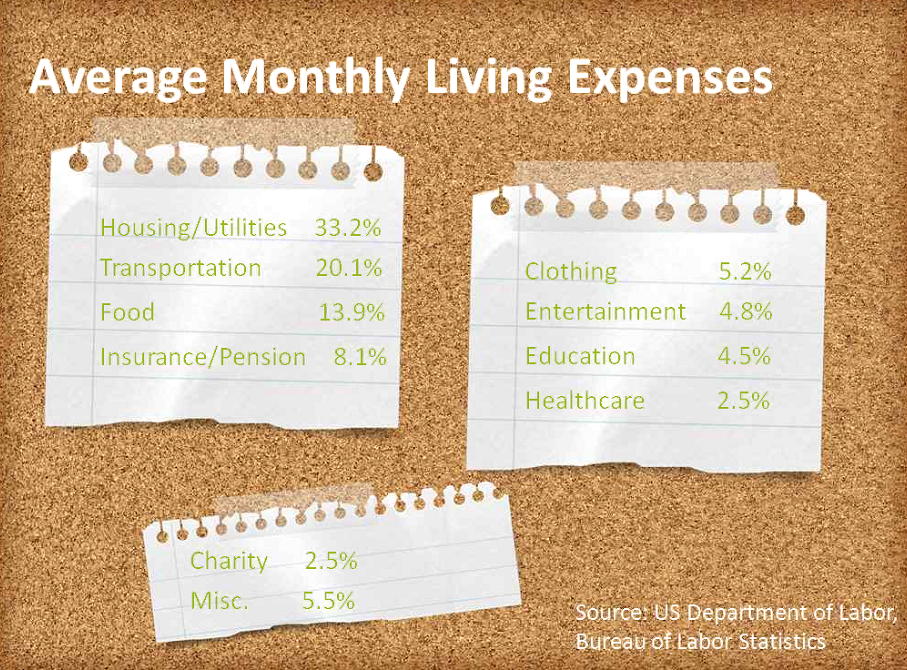

Over the course of the next several weeks track every penny you spend in a notebook, excel spreadsheet, notepad in your phone or whatever works best for you. Just be sure to account for every penny you spend. You will not only see where your money is going but you can decide whether all your purchases were wise or necessary. Here are some average monthly living expenses according to the US Department of Labor:

Step 2) Collect all sources of income.

List financial assistance paid directly to you each month, family help, anticipated job income, work study income, child support payments, food stamps, and any other source of money you receive.

Step 3) Collect all expense information.

As you write down our expenses you will probably start to see areas of unnecessary spending and opportunities to cut back. Your Estimated Cost of Attendance at UM can give you an idea of what estimated expenses you can expect and here is precise information about the UM Student Tuition and Fees.

It is a great practice to consider adding to your savings account as a "bill"; even if you can only set aside $25 a month it's a great habit to start! You can even do the same thing with your student loans. Paying even a small amount each month toward the principle or interest on your loans can go a long way! For more information, go to the "While You're In College" tab on the Student Loans page.

Step 4) Form a budget using the information you collected.

There are many budgeting tools available to you! From electronic to paper and pencil to apps, there are many types of budgets available. Click on the next tab to see the types of budgeting systems available to you!

Online Budget Managers:

Using an online budgeting tool such as mint.com can link to your bank account and credit cards and place transactions into budgeting categories for you. This can be helpful for individuals who have little time to work on their budget. These systems can structure your budget for you as well as display your expected excess or shortcoming for the month.

Budgets on Excel:

Excel budgets can give you control over how your budget is constructed and the outputs it gives while still doing the arithmetic for you:

Here is an Excel budget for an entire year. Before you begin working on this budget, start by using the Expenses Checklist to find what you spend your money on throughout an entire year. Then use the Income Checklist to account for all the income for your household. Use the information on both checklists to fill in the Excel budget, it's as easy as that!

Paper and Pencil Budget:

Here is a PDF of a paper budget form that will help you prepare for one semester at a time. Have a hard time making your Refund Check last the entire semester? Can't seem to keep track of your money so you can pay your Deferred Payments? This may be the budget form for you!

Come by the Office for Student Success front desk in Lommasson 269 to schedule an appointment for assistance in filling out the information for your budget.