Student Loans

Video: How to Blow Your Refund

Financial Aid Is Not Endless

You apply for student loans the same way you apply for all other federal financial aid: through your FAFSA (for questions on the FAFSA see our FAFSA page). Once you fill out and submit your FAFSA, you wait until the Department of Education and the University of Montana decide what aid to offer you. The aid you are offered is just that: an offer! There is no obligation to take everything offered to you.

Once your Financial Aid Award is determined, you will receive your Financial Aid Package in your Cyberbear account. This will contain any federal or state scholarships, grants, work-study, tuition wavers or loans they are offering.

Before you take out a student loan: have you been offered any grants, scholarships, work-study or tuition waivers? These are free money that you do not have to repay. Always accept them first.

If you have been offered work-study, we also recommend accepting this before student loans. Work-study is earned by students through working a part-time job on campus or for certain approved off-campus employers. The electronic job board for the University can help you find both work study and non-work study employment opportunities.

If you still have school related expenses (tuition, fees, room & board, textbooks, essential personal expenses, school-related transportation expense, etc.) that are not covered, you may want to consider taking out a loan to cover these costs. But take the time to think about what you will be able to repay after graduation (see Accepting Student Loans tab).

Know Your Limits:

You should estimate what your student loan repayment amount would be and compare your estimated payment to your projected income after earning your degree. Can you support a payment of that amount? Should you take out less so your payments will be smaller? These are all things to consider before accepting the loan.

Here is a calculator that compares your estimated hourly salary to the amount of loans you can afford to borrow. Use this calculator to help you estimate a manageable amount of loan debt and then use that estimate to guide your borrowing patterns.

Interest rates on Federal student loans depend on the year in which the loan is disbursed. Here is information about current interest rates on Federal student loans. If you would like to know the historical trends on Federal interest rates, here is that information as well.

You always have the option to decline or reduce the amount of loan money you are offered. If you are offered a loan you don't want to accept or if they are offering more than you need, you are not obligated to take on that debt. Contact the FIancnail Aid Office to reduce the amount of the loan you wish to borrow.

Know The Limits of What The Government Will Offer You:

The government will not offer you an endless amount of money! There are annual and aggregate(i.e. total amount) limits to the principle of the loans you will be offered and once you reach those limits, you will not receive any more. This link has a chart from the Federal Student Aid Office detailing these loan limits.

Be aware that dependent undergraduates cannot borrow more than an aggregate principle amount of $31,000 in Federal Subsidized and/or Unsubsidized loans, independent undergraduates cannot exceed $57,500 and graduate/professional students cannot go over $138,500. For select health professional programs the aggregate limit will be $224,000.

Once You Make Your Decision:

Once you decide that you want to accept all or part of a student loan, you will sign a Master Promissory Note (MPN) in which you promise to repay your loan(s), and any accrued interest and fees. Here is more information about what the MPN is.

You will also need to go through Loan Entrance Counseling which will give you information about your loan, how it functions, the repayment process and learn a little about personal finance as well.

Once your loans are disbursed (i.e. you receive the loan money), you can use that money to pay for your school related expenses.

As long as you are enrolled at least half time as a student (UM students: that means you need to be taking at least 6 credits per semester), your loan will be in a status called "In-School Deferment". This means you will not have to make payments on your loans while taking classes.

Even while you are in In-School Deferment, interest will still be accumulating on some of your loans. If you have a Subsidized Loan, the Department of Education will pay for the interest for you while you are in school at least half time. Perkins loans will also not accrue interest while you are taking at least 6 credits per semester. If you have any other type of loan, you are responsible for the interest that accrues while you are in school. You do not have to make payments towards that interest but you can choose to pay the interest while you are in school if you wish.

The National Student Loan Data System website contains all the information about all of your student loans all in one place. If you want to see the total amount you have already borrowed or want to know the interest rates on your loans or want to see how much interest has accumulated or see who you repay your loans through, this site is where you should go! You will need your FSA ID in order to log in.

There is no penalty for paying towards your loans while you are a student!

We encourage students to start paying towards their loans while they are still in school. Even $5 a month can make a difference!

A $2000, Unsubsidized loan earns about $9 in interest a month. By cutting out just two coffee purchases a month and putting that money towards your loans, you can pay off your monthly loan interest on a loan!

Occasionally students will need to obtain an Enrollment Verification Certificate in order to prove their enrollment status to their employer, landlord, loan servicer, etc.. This information is housed in the National Student Clearing House which is a verification and reporting organization that holds enrollment and degree information on more than 144 million students nationwide.

UM students can get an Enrolment Verification Certificate thru National Student Clearinghouse by going to their Cyberbear account.

If your credit load drops below half time (6 credits a semester for UM students), the grace period on your loans will start. For Perkins Loans, the mandatory grace period is 9 months. For Subsidized, Unsubsidized and PLUS loans the mandatory grace period is 6 months.

Once your grace period is over, you will be in repayment on your loans.

At this point, you need to contact your servicer as they initiate your repayment process. There are currently 9 major national servicers, you can find out who your servicer is by logging into NSLDS.

- Great Lakes

- Phone: (800) 236-4300

- Fax: (800) 375-5288 (Great Lakes requires this fax cover sheet)

- Nelnet

- Phone: (888) 486-4722

- Fax: (866) 545-9196 (for documents related to deferment, forbearance, repayment plans, or enrollment status changes)

- Aidvantage (previously Navient and Sallie Mae)

- Phone: (800) 722-1300

- Fax: (866) 266-0178

- EdFinancial

- Phone: (855) 337-6884

- Fax: (800) 887-6130

- MOHELA

- Phone: (888) 866-4352

- PSLF Phone: (855) 265-4038

- Fax: (866) 222-7060

- OSLA

- Phone: (866) 264-9762

- Fax: (855) 813-2224

For individuals with loans issued before 2010 in Montana you may have the following State servicer

- Aspire Servicing Center

- Phone: (800) 243-7552

- Fax: (515) 471-3983

For individuals with loans issued by the University of Montana (such as Perkins Loans or other UM loans) you have the following institutional servicer

- ECSI

- Phone: (800) 334-8609

- https://heartland.ecsi.net/

- For Perkins related questions, contact The University of Montana Perkins Loan Representative

- Joneal Szwedkowicz

- Phone: (406) 243-5593

- Fax: (406) 243-4867

- joneal.szwedkowicz@mso.umt.edu

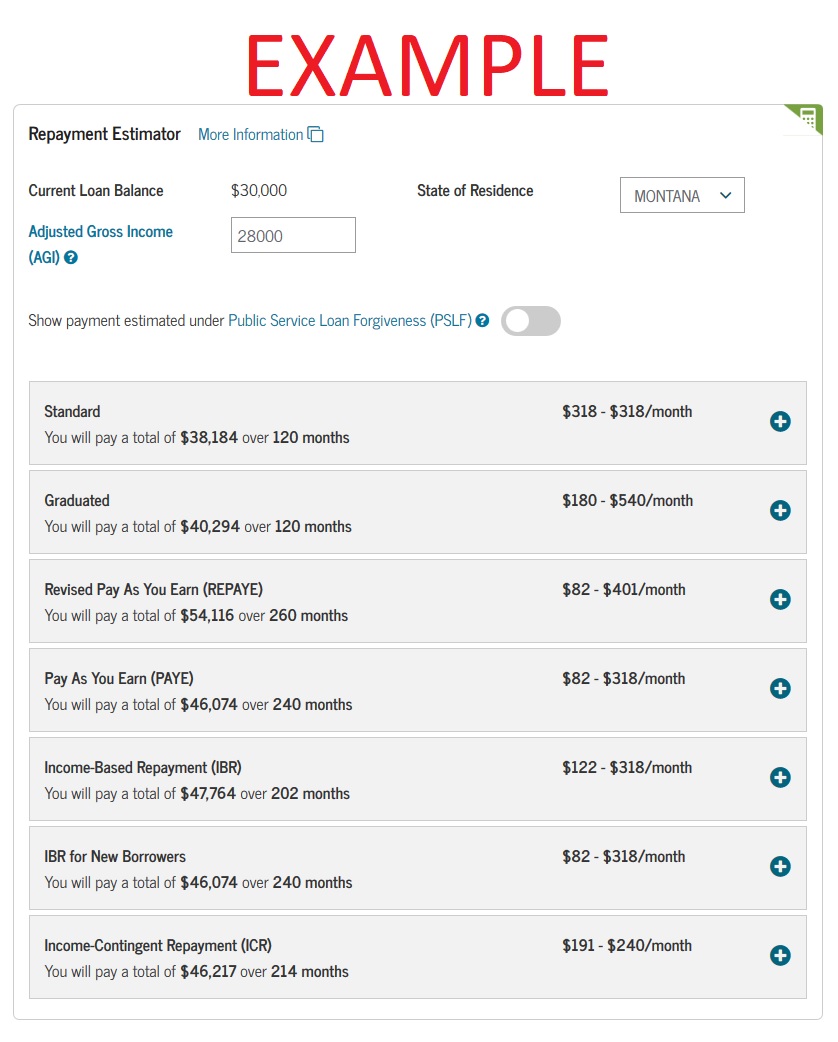

The good news is you have a lot of repayment options for your Federal student loans and you can switch your repayment plan at any time. Below you will find a basic outline of each plan; conditions and qualifications for these repayment options apply for each plan.

*Keep in mind that Perkins loans do not have these repayment options.

Standard Repayment Plan -- Payments are a fixed amount of at least $50 per month and the loan is paid off in 10 years.

Graduated Repayment Plan -- Payments are smaller at first and then increase gradually, usually every two years, and the loan is paid off in 10 years.

Extended Standard Repayment Plan -- Requires a principal balance totaling at least $30,000. Payments are a fixed amount and the loan is paid off in 25 years.

Extended Graduated Repayment Plan -- Requires a principal balance totaling at least $30,000. Payments are smaller at first and then increase gradually, usually every 2-4 years, and the loan is paid off in 25 years.

Revised Pay As You Earn (REPAYE) Repayment Plan -- Your maximum monthly payments will be 10 percent of discretionary income (the difference between your adjusted gross income and 150 percent of the poverty guideline for your family size and state of residence) (other conditions apply).

Pay As You Earn (PAYE) Repayment Plan -- Your maximum monthly payments will be 10 percent of discretionary income (the difference between your adjusted gross income and 150 percent of the poverty guideline for your family size and state of residence) (other conditions apply).

Income-Based Repayment (IBR) Plan -- Your maximum monthly payments will be 15 percent of your discretionary income (the difference between your adjusted gross income and 150 percent of the poverty guideline for your family size and state of residence) (other conditions apply).

Income-Based Repayment (IBR) Plan for New Borrowers -- Your maximum monthly payments will be 10 percent of your discretionary income (the difference between your adjusted gross income and 150 percent of the poverty guideline for your family size and state of residence). You're considered a new borrower on or after July 1, 2014, if you had no outstanding balance on a Direct Loan or FFEL loan when you received a Direct Loan on or after July 1, 2014 (other conditions apply).

Income-Contingent Repayment (ICR) Plan -- Payments are the lesser of 20% of your discretionary income (the difference between your adjusted gross income and 150 percent of the poverty guideline for your family size and state of residence) or what you would pay under a 12 year standard plan, whichever is greater (other conditions apply).

Income-Sensitive Repayment Plan -- Your monthly payment is based on annual income, but will never drop below monthly interest accrual. Available for FFEL loans only.

Here is a repayment estimator that compares estimated monthly payments for all repayment plans you are eligible for.

Here is more detailed information on all repayment options.

If you wish to change your repayment plan to one of the Income Driven Repayment Plans, log into studentloans.gov and click "Apply/Re-Certify/Change an Income-Driven Repayment Plan". You will need your FSA ID in order to log in; if you are married your spouse will need an FSA ID as well.

Many people think they have to consolidate their loans after leaving college.

Borrowers should actually be very careful when consolidating as consolidation never saves you money, it actually costs you more in the long run. When you consolidate Federal loans, the interest rate of your new loan is a weighted average of the interest rates you already have with that average rounded up to the nearest 1/8 th of a percent. Also the consolidation will buy out both the principle and interest of the loan as principle for the new loan. Between the rounded up interest rate and this capitalization of your interest, consolidation always costs the borrower more in the long run. Don't consolidate to save money, it doesn't work that way.

There are a few cases when you should consolidate though:

- Borrowers receive one bill per servicer not one bill per loan. If you have multiple loan servicers (find out through StudentAid.gov) a consolation can bring you down to one servicer a.k.a. one bill per month.

- If you need to have access to a longer repayment term than the 25 year term you have in the Extended Standard Repayment Plan, a consolidation can give you a 30 year term. However we rarely advise you take this route as the interest costs over a 30 year term are very high.

- If you have non-Direct loans but want to be eligible for Public Service Loan Forgiveness (PSLF), you will need to consolidate those non-Direct loans to make them eligible for PSLF. Be very careful when doing a consolidation for PSLF; you want to make sure you are consolidating only your non-Direct loans. If you consolidate a loan that is already Direct, you may loose previously qualifying months towards PSLF.

If you decide that you would benefit from consolidation by one of the three reasons listed above, you can do that consolation at studentaid.gov. Log in with your FSA ID and click "Complete a Consolidation Loan Application and Promissory Note".

Public Service Loan Forgiveness (PSLF)

After 10 years(120 months) of full-time employment with a government entity or non-profit while making full, on-time payments on a qualifying repayment plan, you may qualify to have the remaining balance of your loans forgiven.

There are several other qualifiers that have to be meet in order to be eligible for this type of loan forgiveness such as having only Direct Loans, having FedLoan Servicing as your servicer and having a specific type of repayment plan. Here is a Q&A by the Department of Education about PSLF.

The UM Financial Education Program has also created a streamlined handout to help you see if you meet the requirements for PSLF or if you need to complete a task in order to be eligible for PSLF.

Here is the PSLF Form for PSLF certification. This form (which is submitted to FedLoan Servicing) will certify that your employer does in fact qualify your loans for the PSLF program. FedLoan Servicing will then tell you how many qualifying months you have and how many months you have left to complete. Note that this is NOT an application for loan forgiveness it just certifies that you will qualify for PSLF and verifies how many qualifying months you currently have. Once you have accrued 120 qualifying payments, you will need to complete and submit the Application for Public Service Loan Forgiveness in order to receive forgiveness of your Federal Student Loans.

If you would like assistance with PSLF or have questions about the process, please contact the appointment scheduler for the UM Financial Education Program at (406)243-2800 to schedule an appointment.

**UPDATE** On May 23, 2018 the Department of Education released information about a "fix", called Temporary Expanded Public Service Loan Forgiveness (TEPSLF). Congress created TEPSLF to assist borrowers who had their PSLF application denied because they did not make all 120 payments on the correct repayment plan. Information about TEPSLF is available here.

Teacher Loan Forgiveness

The federal government has loan forgiveness for up to a total of $17,500 on Subsidized and Unsubsidized loans for individuals who teach full-time for 5 consecutive years at a school that serves low-income families and meets other qualifications. Here is the site with details on this type of loan forgiveness as well as the application for it. Check the site to see if you a eligible for this forgiveness.

Note that most teachers do not see this program covering a substantial amount of their loans and thus choose to use PSLF instead of Teacher Loan Forgiveness.

VA Student Loan Repayment Program

The Department of Veterans Affairs has loan forgiveness of up to $10,000 per year, with a lifetime maximum of $60,000, to help employees repay their student loans. Any VA employee is eligible, except those occupying a position excepted from the competitive civil service. An employee receiving this benefit must sign a service agreement to remain in the service of the VA for a period of at least 3 years. Here is the summary of VA Education Support.

National Health Service Corps Loan Repayment Program

This loan repayment program helps licensed primary care clinicians in eligible disciplines have the opportunity to receive loan repayment assistance through the NHSC Loan Repayment Program (NHSC LRP). In exchange for loan repayment, clinicians serve at least two years of service at an NHSC-approved site in a designated Health Professional Shortage Area (HPSA). NHCS Loan Repayment funds are exempt from Federal income and employment taxes, see page 5 in the NHSC Program Guidance.

Who is eligible? Those in the medical, dental, behavioral health, social work, therapy and counseling service industries.

Service Options/Award Amounts (For more information see "Benefits of the NHSC LRP" section of website)

- 2 Year Full-Time Clinical Practice

- HPSA scores of 14 or higher, up to $50,000

- HPSA scores of 13 or lower, up to $30,000

- 2 Year Half-Time Clinical Practice

- HPSA score of 14 or higher, up to $25,000

- HPSA scores of 13 or lower, up to $15,000

Note that half-time practice is not available to those serving under the Private Practice Option. See "Practice Types" page 22 in the NHSC Program Guidance.

Eligibility Requirements for NHSC Loan Repayment Program

- U. S. Citizen

- Provider in the Medicare, Medicaid, and Children’s Health Insurance Programs

- Licensed, Certificate or Registered

- Eligible for federal employment

- Submit a complete application before deadline, for more information see "Application Requirements" section of website

Priority can be given to applicants who are:

- Current/Former NHSC Scholarship Awardees

- Likely to remain in a HPSA plus Disadvantaged Background in HPSA

Selection Factors: Applicants who have a history of not honoring prior Federal legal obligations will not be selected.

Note: a credit check will be performed as part of the application review process.

What happens after you apply (For more information see "After You Apply" section of website)

- Review your application status through the Bureau of Health Workforce (BHW) Customer Service Portal

- Learn how NHSC prioritizes their loan repayment funding

- Complete your acceptance if you are an Award Finalists. For more information see "Notifying Award Finalists" section of website

- Know your contract and service obligations. For more information see "NHSC LRP Contract & Service Obligation" section of website

For additional questions, contact the Bureau of Health Workforce (BHW) at (800) 221-9393 and Select Option #1 and review the NHSC Loan Repayment Program Application and Program Guidance

Nurse Corps Loan Repayment Program

The purpose of the Nurse Corps Loan Repayment Program (LRP) is to provide loan repayment assistance to professional registered nurses (RNs), including advanced practice nurses (APRNs), in return for a commitment to work at eligible health care facilities with a critical shortage of nurses or serve as nurse faculty in eligible schools of nursing.

Who is eligible? The Nurse Corps LRP offers RNs and APRNs substantial financial assistance to repay a portion of their qualifying educational loans in exchange for full-time service either at a Critical Shortage Facility or an eligible school of nursing see “Are you eligible for loan repayment?” section of website.

Benefits of the Nurse Corps LRP (For more information see "Why should you apply?" section of website)

- Fulfill your passion to care for underserved people in some of the neediest communities across the country.

- Loan Repayment- funds are provided to participants to repay a portion of their outstanding qualifying educational loans

- 60% of Total Qualifying Nursing Educational Loan Balance- for initial two-year service commitment (30% for each year)

- Additional 25% of Total Qualifying Nursing Educational Loan Balance- for an optional third year of service

For information on the following characteristics of the Nurse Corps Loan Repayment Program, see the respective pages of the Nurse Corps Loan Repayment Program Application and Program Guidance

- Eligibility: pages 6-8

- Health Care Facility Types: pages 9-11

- Loan Eligibility: page 14

- Award Process: page 15

- Service Requirements: page 16

Perkins Loans

Perkins Loans are eligible for cancellation depending on they type of employment you have. A certain percentage of your Perkins Loans can be canceled for each year of service you complete in a variety of employment areas including but not limited to:

- Volunteer in the Peace Corps or ACTION program (including VISTA)

- Teacher

- Member of the U.S. armed forces (serving in area of hostilities)

- Nurse or medical technician

- Law enforcement or corrections officer

- Head Start worker

- Child or family services worker

- Professional provider of early intervention services

Here is a complete chart of the cancellation conditions for Perkins Loans. Since Perkins loans are issued by the University you attend, you must contact your campus to request Perkins Loan cancellation. For Perkins Loans issued by the University of Montana, contact Joneal Szwedkowicz in Business Services by email or call (406) 243-5593.

Repayment Plans that Contain Loan Discharge

Many of the Income-Driven Repayment Plans contain loan discharge however **in these cases you may be taxed on the discharged portion as income.** Be aware that you could see a significant increase in that years Income Tax if you have a large amount of loans discharged from one of these plans! Because of this fact, we do not advise that borrowers use this as a long term solution for their debt.

Income-Based Repayment Plan (for those who are not new borrowers* on or after July 1, 2014)

If you have not repaid your loan in full after making the equivalent of 25 years of qualifying monthly payments, any outstanding balance on your loan will be forgiven and you may have to pay income tax on that amount.

Income-Based Repayment Plan( for those who are new borrowers* on or after July 1, 2014)

If you have not repaid your loan in full after making the equivalent of 20 years of qualifying monthly payments, any outstanding balance on your loan will be forgiven and you may have to pay income tax on that amount.

Revised Pay As You Earn Plan

If you only have eligible loans that you received for undergraduate study, any remaining balance is forgiven after 20 years of qualifying repayment. If you have any eligible loans that you received for graduate or professional study, any remaining balance is forgiven after 25 years of qualifying repayment on all of your loans. Forgiveness may be taxable.

Pay As You Earn Plan

If you have not repaid your loan in full after making the equivalent of 20 years of qualifying monthly payments, any outstanding balance on your loan will be forgiven and you may have to pay income tax on that amount.

Income-Contingent Repayment Plan

If you have not repaid your loan in full after making the equivalent of 25 years of qualifying monthly payments, any outstanding balance on your loan will be forgiven and you may have to pay income tax on that amount.

*For the IBR Plan, you are a new borrower on or after July 1, 2014, if you had no outstanding balance on a William D. Ford Federal Direct Loan (Direct Loan) Program loan or Federal Family Education Loan (FFEL) Program loan when you received a Direct Loan on or after July 1, 2014. (Because no new FFEL Program loans have been made since June 30, 2010, only Direct Loan borrowers may qualify as new borrowers on or after July 1, 2014.)

If you cannot make your current payment consider

- Switching to another repayment plan with a lower minimum payment

- Requesting a Deferment

- Requesting a Forbearance

What is a Deferment?

A deferment is a period during which repayment of your loan is temporarily delayed. During a deferment, the Federal government will pay the interest on your Perkins and Subsidized loans; you will be responsible for any interest accrued from Unsubsidized or PLUS loans. Go to this site to see if you are eligible for a deferment. Contact your servicer if you need a deferment for your student loans.

What is a Forbearance?

A forbearance is a period during which repayment of your loan is temporarily reduced or delayed. But unlike deferment, you are responsible for all the interest that accrues on your loans. So deferment is a better option than forbearance! If you have to take a forbearance, contact your servicer. This site has information on the types of forbearance available.

If you do not make any payments on your loans they can go into Default

A Federal student loan enter default when your last payment is over 270 days (that's 9 months) late.

The penalties that come along with default are pretty sever:

- Collections costs are added at 24% on the principle and interest of your loan

- The Federal Government will take 15% of your paycheck as a wage garnishment

- Even if you receive Social Security, those will be garnished at 15% as well.

- You will not receive a Federal and State tax refund while your loans are in default

- All of this information goes on your Credit Report

Loan Rehabilitation

If you do happen to be in default, there are certainly ways to get out. You can rehabilitate your loans through the collections agency that holds your loans.

- For Federal Direct Loans: The Debt Management and Collection Service of the Department of Education can tell you which collections agency has your loans. They can be contacted at

- Debt Management and Collection Service

- (800) 621-3115

- Debt Management and Collection Service

- For Loans Serviced by Aspire: These loans were guaranteed by the state of Montana (instead of the Federal government as they now are). Aspire can be contacted at

- Aspire

- (800) 243-7552

- Aspire

Working with your agency can rehabilitate your loans and get back into repayment a process which can take 9 months. After rehabilitation, the collections fee drops from 24% to 16% and the information is dropped from your credit report, making loan rehabilitation a worthwhile process to go through.

You Should Never Have To Pay Money To Get Money

Legitimate lenders and student loan companies will NEVER ask for fees up front. They will generally take a percentage of the loan they are issuing to you when everything is complete so that you do not have to pay out of pocket or they will tack their fee on the amount owed so you pay it back when you are in repayment. Either way, you actually get what you pay for, which cannot be said for the scams described below.

Third Party Corporations

These corporations repeatedly contact borrowers about "services" they can offer on behalf of the borrower. They typically require maintenance fees in addition to the loan payment in order to "consolidate" your loans, "manage repayment", etc.. Some cases we have seen even had borrowers erroneously sign over Power of Attorney to the company in order to "maintain" their Student Loans.

You do not have to pay anyone to do a consolidation, repayment plan change or loan rehabilitation for you! There are no additional fees for any of these procedures. You have worked hard for the money you have and any money spent on your student loans should go to your student loans. You do not need any other company to work for you in order to successfully pay off your student loans; always work directly with your servicer to see what options you have available.

Here is an article from USA Today about scams like this and how to safely get out of them.

Loan Consolidation Scams

Recent graduates are being hit with student loan consolidation scams promising to consolidate their loans for a fee (processing fee, administrative fee, consolidation fee, etc.). Some scams will tell you it lowers your minimum monthly payment. These companies will take your money and either do nothing, or they will move your Federal student loans into a private loan (loosing all the consumer protection benefits that come with Federal loans).

Loan consolidation is when several loans are lumped into one loan so the borrower has one payment to make instead of many. This can be a good option for some borrowers. However, you should never pay money to have your student loans consolidated. And consolidation just puts all of your loans into one place, it won't lower your balance or interest rate.

Link to Federal Student Loan Consolidation Site if you choose to do so. It is FREE and takes only 30 minutes.

Refinancing Fee Scams

This scam involves a company approaching borrowers and saying that they will negotiate, on your behalf, with your servicer in order to get you a better interest rate on your student loans. They will show you cases where other clients have saved thousands of dollars by working with them. They will as for a fee in exchange for these services.

This is a scam not only because real lenders will not charge fees up front (they will instead take a fee when they close the loan, typically from the loan amount), but because you cannot refinance your Federal student loans. Currently there is no way to change the interest rate on your student loans (other than loan consolidation, see above) and the only way that could change is if Congress passed a law allowing borrowers to refinance their loans.

Loan Elimination Scams

These scams involve a company contacting you saying that, for a fee, they can negotiate the settlement of your student loans (that is, paying a lump sum of money that is less than the amount you owe, usually pennies on the dollar). They will take your money and nothing will change with your loans...because settlement is not an option with Federal student loans!

Your Federal student loans are a contract between you and the Federal government. There are only three ways to get rid of your student loans: the borrower pays them off (or some combination of payment with loan forgiveness), the borrower becomes totally and permanently disabled, or the borrower pass away. You cannot negotiate the terms of the loan because they are set in Federal statute (that is, Federal law). Go to the "Paying Off Student Loans" tab on this webpage for legitimate repayment options.

FAFSA Scams

FAFSA stands for Free Application for Federal Student Aid. It has the word "Free" in the title, so you should NEVER pay money to file your FAFSA! There are several sites that promise to help you fill out your FAFSA...after you pay almost $80 in fees. While these companies will walk you through the FAFSA, there is no reason for you to pay for something that can be done on your own. Also, the FAFSA has recently been shortened so it is quicker to fill out.

Link to FAFSA Application Site and it's the one that's free!!

Instead of paying that money towards an application that's free to fill out, use that $80 on rent, tuition, books and other items that are related to your education!