Saving

Video: 10-Minute Daily Financial Workouts

Don't spend money you don't have

It is possible to save money in and after college! Here are some examples and ideas:

Entertainment

Missoula is a great city for free or cheap entertainment! Search the Missoula Events website for music, art, sport, food or educational entertainment available in the city (note: not all events are free however you can search for ones that are). During the summer months, there is a free concert every Thursday evening in Caras Park as well as food vendors and entertainment for the kids. You can find more information on DownTown Tonight here.

Missoula also has a monthly event called First Friday where downtown businesses, galleries and museums stay open late so the public can enjoy new art exhibits and socialize with artists and gallery owners. More information on First Fridays can be found here.

For students who have paid the full-time athletic fee, you can now get your Griz student tickets online! Griz Student Ticking has more information about how to get tickets to the athletic events online.

The Missoula Public Library is an amazing resource for free entertainment in books, audiobooks, DVDs and CDs. And they have extended their collection to the digital world! Through an application called OverDrive, you can borrow ebooks and audiobooks instantly from the Missoula Public Library: all you need is Internet connection and a library card!

Gas

As a general rule, gas stations raise their prices between 10am and noon so filling up earlier in the day will usually get you a better price. Also, gas prices usually go up by Wednesday as stations are prepping for pre-weekend price increases. So filling up early in the morning, before Wednesday will help you save on gas prices!

Movie Tickets

By purchasing your movie tickets at a wholesale club you can save up to $3.50 off full price tickets (typically it brings down the price of the ticket to $8). If it's too expensive for you to purchase the package deal, see if you can find some friends to split the pack.

Food

Even if you do not live in the Residence Halls on campus you can still sign up for a Meal Plan with UM Dining called the List of Available Meal Plans at UM Dining. This allows you to buy 80 meals (equivalent to one meal every day for the semester) or 40 meals (equivalent to one meal every other day for the semester) per semester at the Food Zoo for you to use at your convenience. This is a wonderful money-saving option for those on campus!

You can save money on your groceries by making and following a shopping list instead of making impulse purchases. Choosing generic brands (such as store brands) over name brands will also save you money since the generic brands do not have the advertising costs that the name brands do. Coupons are also a great way to save on your grocery costs. There are so many blogs on the Internet that offer great advice on couponing, how to coupon and what coupons to use this week. Here is a coupon blog that has a great introduction to couponing for beginners! Keep an eye on the workshop schedule for upcoming workshops about coupons and how to significantly decrease your grocery spending.

Hard times can hit anyone and college students are no exception to this. Over 12% of Montanans use food stamps and nation wide over 46 million Americans use the food stamp program. If you find yourself not able to purchase groceries after paying your monthly bills, you may be eligible for food stamps thru the Supplemental Nutritional Assistance Program (SNAP). If you are interested in seeing if you are eligible for SNAP food stamps, you can use this prescreening to see if you qualify for SNAP benefits in the state of Montana. If you are eligible for food stamps, you can apply for Montana SNAP Benefits here. If you have other questions about food stamps, visit the SNAP benefits website.

Textbooks

Ways to cut the cost of expensive textbooks can be hard to find, but it's not impossible! Searching for your textbooks online can significantly reduce the final price of your books especially if you are willing to get a previously owned textbook. An alternative to this would be to rent some of your textbooks from The Bookstore. Once you are done with your textbook you also have the option to sell your textbook back to The Bookstore, one of the resale options around town or to sell it online. There are some good ways to get a little bit of money back if you do not want to keep your textbook for reference.

Microsoft Office 365

The University of Montana is now providing Microsoft Office 365 ProPlus for free to currently enrolled students through the Microsoft Campus Agreement. Students may install this software on up to five computers – PC or Mac – and five mobile devices – Apple iOS, Android and Windows Mobile.

Detailed information about Office 365 ProPlus is available on the IT website. Questions may be directed to IT Central at 406-243-HELP (4357)

Funding Your Education Through Employment

There are some companies who provide financial assistance to their employees as they pursue higher education. This list of Missoula employers is not exhaustive nor is it a guarantee of assistance (as always, rules and limitations may apply), but the UM Financial Education Program wants to offer a starting point for students considering outside funding sources when it comes to paying for their college education.

Best Buy

If you are a full time employee (must be listed as a full time employee in the HRIS system) who has completed six months of continuous service on or prior to the start date of course work you are eligible for their tuition assistance program. They will cover eligible expenses for undergraduates up to $3,500 a calendar year, and up to $5,250 for graduates in a calendar year.

Chipotle

Full time and part time employees are eligible for tuition assistance. You can receive up to $5,250 in tuition assistance. They can also offer up to 44 credit hours with on-the-job training as you get promoted at Chipotle.

Home Depot

Salaried employees, full time, and part time associates are eligible to apply after 90 days of service. Salaried employees may receive up to $5,000 in a calendar year. Full time employees can get up to $3,000 in a calendar year. Part time employees may receive up to $1,500 in a calendar year.

McDonald’s

Employees must have 90 days of service to be eligible with at least 15 hours of work each week. Crew members are eligible for $2,500 a year. Managers are eligible for $3,000 a year.

Verizon

Employees working at least 20 hours a week are eligible for assistance. Full time employees are eligible for up to $8,000 a year. Part time employees are eligible for up to $4,000 a year.

The University of Montana

Permanent employees working at least .75 FTE (full-time employment) and who have obtained supervisor and administrative approval can apply for their tuition costs to be waived. Also, UM employees can have a 50% tuition waiver for qualifying dependents.

Wells Fargo

They offer up to $5,000 per year. They also offer several scholarships for dependent children of team members, ranging from $1,000 to $3,000.

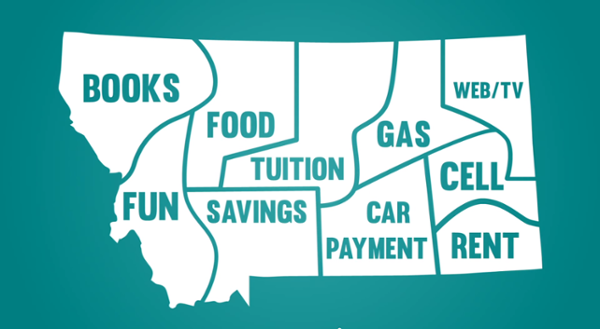

Saving money can help you achieve your goals, gain financial stability and prepare for future emergencies.

Get in the habit of transferring funds to your savings account every month. Even if you're only able to save $10 or $25 a month, that can enable you to have an emergency fund available should an immediate need arise!

After you graduate and have a larger income, experts suggest that you put at least 10% of your monthly gross income (that is, the amount of money you make before taxes) into your savings account.