VIII.8. State Debt

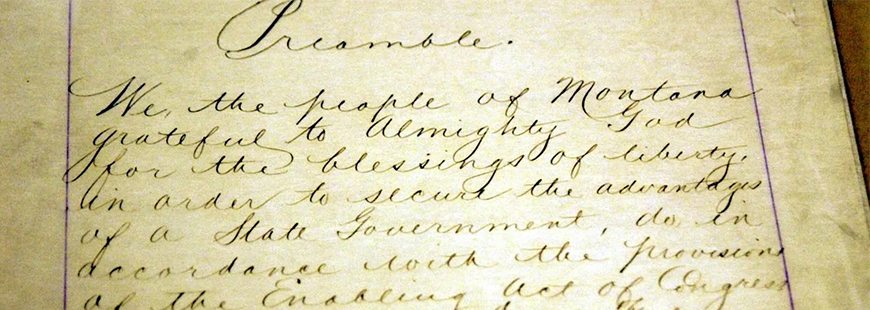

Montana Constitution of 1972

Article VIII, Section 8. State debt. No state debt shall be created unless authorized by a two-thirds vote of the members of each house of the legislature or a majority of the electors voting thereon. No state debt shall be created to cover deficits incurred because appropriations exceeded anticipated revenue.'

History

Sources

1884 Montana Constitution (proposed)

Article XIII, Section 3. The Legislative Assembly shall not in any manner create any debt or debts, liability or liability, which shall singly, or in the aggregate with any previous debt or liability, exceed the sum of One Hundred Thousand Dollars, ($100,000) except in case of war, to repel invasion, or suppress insurrection, unless the same shall be authorized by law for some single object or work, to be distinctly specified therein, which law shall provide ways and means, exclusive of loans, for the payment of the interest of such debt or liability as it falls due, and also for the payment and discharge of the principal of such debt or liability within twenty (20) years of the time of the contracting thereof, and shall be irrepealable until such time as the principal and interest thereon shall be paid and discharge ; but no such law shall take effect until at a general election it shall have been submitted to the people, and shall have received a majority of the votes cast for and against it at such election, and all monies raised by authority of such law shall be applied only to the specific object therein stated, or to the payment of the debt thereby created ; and such law shall be published in at least one (1) newspaper in each county, if one be published therein, throughout the state, for three (3) months next preceding the election at which it is submitted to the people. The Legislative Assembly may at any time after the approval of such law by the people, if no debt shall have been contracted in pursuance thereof, repeal the same.

1889 Montana Constitution

Article XIII, Section 2. The legislative assembly shall not in any manner create any debt except by law which shall be irrepealable until the indebtedness therein provided for shall have been fully paid or discharged; such law shall specify the purpose to which the funds so raised shall be applied and provide for the levy of a tax sufficient to pay the interest on, and extinguish the principal of such debt within the time limited by such law for the payment thereof; but no debt or liability shall be created which shall singly, or in the aggregate with any existing debt or liability, exceed the sum of one hundred thousand dollars ($100,000) except in case of war, to repel invasion or suppress insurrection, unless the law authorizing the same shall have been submitted to the people at a general election and shall have received a majority of the votes cast for and against it at such election.

Constitutional Convention Study 15: Taxation and Finance, § XIV State Debt.

The Montana Constitutional Convention Commission provided a thorough analysis of the effectiveness of state debt provisions in the 1889 constitution, state debt across the nation, commonly used debt vessels, and more. Some of the Commission’s recommendations, such as removing a formal debt limit, were topics of great discussion. Ultimately, the Delegates did remove the formal limit. While not all of the Commission’s recommendations were utilized by the Delegates, for example the Delegates included a referendum provision against the Commission’s guidance, the transcripts indicate that the Commission’s work provided many considerations during the creation of Article XIII, Section 8.

Drafting

Revenue and Finance Committee Proposal No. 7

Section 8. STATE INDEBTEDNESS. No state debt shall be created unless authorized by a three-fifths vote of the members of both houses of the Legislative Assembly. State debt cannot be created to cover deficits incurred when appropriations exceed anticipated revenue during any budget period. Vol. II, Committee Proposals 585-586.

Adoption

The Delegates adopted the committee proposal by voice vote, with none opposed, on March 4, 1972. Verbatim Transcript 1508.

Prior to this, Delegate Rygg explained that the $100,000 state debt limit from the 1889 constitution was not appropriate, since such a limit only encouraged circumvention. Following this, there was an extended back and forth between delegates, during which concerns were voiced over the potential for a large state debt and particular wording of the committee proposal. Verbatim Transcript 1490-1503.

One major point of contention was the required three-fifths majority; the required majority was eventually changed by amendment to two-thirds. Additionally, language was added allowing the electorate to authorize state debt. Verbatim Transcript 1503-1505.

Following this, Delegate Ask expressed concern that the language of an approved amendment suggested a majority of all electors, not only those voting, would be required to carry a vote. Delegate Ask then moved to amend section 8, by adding “the majority of the electors voting thereon”. This amendment passed by unanimous voice vote. Verbatim Transcript 1507-1508.

The delegates adopted the final version of Article VIII Section 8 with a vote of 67-28 (5 excused or absent) on March 16, 1972. Verbatim Transcript 2468-2469.

Ratification

1972 Official Text with Explanation: Revises 1889 constitution by replacing obsolete $100,000 limit on state debt with provision that only a 2/3 vote of the legislature or majority vote at an election may create state debt.